- Home

- Property Search

- Sell

- Offices/Agents

- Office Locations

- Mt Pleasant

- Summerville - Main Street

- West Ashley

- Isle of Palms

- Goose Creek

- Summerville - Trolley Road

- Manning/Sumter

- Wyboo Satellite Office

- Palmetto Group

- Myrtle Beach - Satellite Office

- Greenville/Spartanburg - Satellite Office

- Property Management

- All Agents

- Corporate Office

- Title Insurance

- Rental Info

- Neighborhoods

- Blog

- Join AgentOwned

- About

- MORE

-

- My Homes

- My Tours

- My Favorites

- My Searches

- Sign In

- Register

Blog > Some Experts Predict Mortgage Rates to Fall Below 6% Later This Year

Some Experts Predict Mortgage Rates to Fall Below 6% Later This Year

by AgentOwned Realty

Amidst the daily fluctuations in mortgage rates, it's crucial to focus on the broader trend, especially if you are considering buying or selling a home. Compared to the near 8% peak last fall, mortgage rates have shown an overall downward trend.

While short-term volatility is expected due to economic drivers like inflation and reactions to the consumer price index (CPI), experts agree on the likelihood of this downward trend persisting throughout the year.

Though we may not see the record-low rates from the pandemic era, some experts anticipate rates dipping below 6% later this year. Dean Baker, Senior Economist at the Center for Economic Research, states:

“They will almost certainly not fall to pandemic lows, although we may soon see rates under 6.0 percent, which would be low by pre-Great Recession standards.”

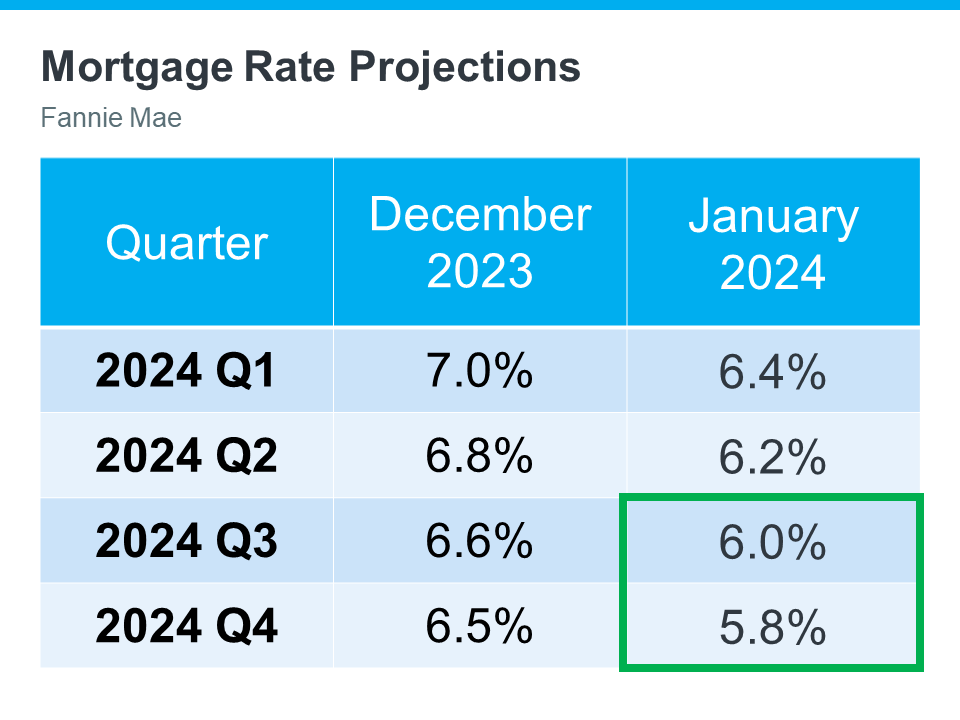

This sentiment is echoed by Fannie Mae projections, suggesting a potential rate below 6% by the year's end. The chart illustrates mortgage rate projections for 2024, indicating a downward trajectory in the updated forecast released just one month later.

While experts continually re-forecast based on market trends and the economy, the consensus is that rates should continue declining, contingent on inflation cooling.

What This Means for You:

While the exact timeline and magnitude of rate changes are uncertain, the current market presents an opportunity, especially in Charleston, SC, where finding a home within budget can be challenging. With rates already lower than last fall, seizing the moment is advisable, as even a small quarter-point dip can enhance your purchasing power.

Bottom Line:

If you've been considering a move and were waiting for rates to fall, now may be the opportune time to act. Connect with AgentOwned Realty, your local real estate expert in South Carolina, to navigate the evolving market and initiate your real estate journey.

If you’re looking for your dream home, or if you need to sell your existing home, we can certainly help, our agents are ready and able! Agent Owned is a full service brokerage that can assist you in getting pre-qualified to loan approval. We can help you with title insurance, home insurance and the warranties you need to protect your most valuable asset. At AgentOwned, we have helped thousands of people buy and sell their homes, we have been in business for over 30 years and know what it takes to get the job done right the first time.

Each agent has access to a team of qualified professionals from attorneys to mortgage specialists and access to a knowledge base of highly experienced Brokers that can handle any situation. Find the right agent now at: https://www.agentowned.com/all-agents

To learn more about South Carolina including schools, employment and more see: https://www.agentowned.com/moving-to-south-carolina

If you’re interested specifically in the Greater Charleston area see: https://www.agentowned.com/moving-to-charleston-sc

If you’re looking for information about Manning, Sumter and the Lakes Area, see: https://www.agentowned.com/moving-to-manning-sumter

And if you’re interested in the greater Anderson area see: https://www.agentowned.com/moving-to-anderson